The principals of Stonebridge have executed sixteen commercial projects in Moscow over a thirteen year period. Essentially all were gut renovations of centrally-located buildings in poor condition at the time of acquisition. All were stabilized and then operated as “best in class” properties. Two projects were sold.

The unlevered IRR’s of previous projects have ranged from a minimum of 30% to a maximum of 129% and have a weighted average IRR (based on equity invested) of 69%.

The average hold period was approximately 6 years (through 2008)

The projects fall into two primary categories:

high street retail renovation and repositioning and

major capital redevelopment of commercial office buildings.

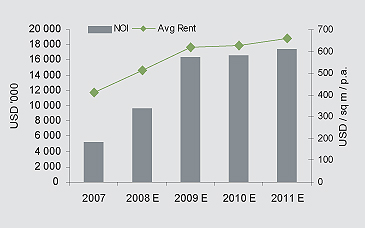

Forecasted NOI and Avg. Rent Growth of portfolio: